Impact Investing

Miller Center aspires to be the go-to partner on the demand side of capital and form partnerships across the capital spectrum to ensure our social enterprise alumni have access to the right capital at the right time.

Miller Center Capital

Investing first to catalyze the growth of women-led and locally led social enterprises

Opportunity

Miller Center for Social Entrepreneurship has a robust network of social enterprises that can change the world with access to capital. This fund will help catalyze the growth of our highest potential social enterprise alumni.

Seeking philanthropic investors and donors to contribute in the form of recoverable and traditional grants.

For more information, contact MillerCenterInvest@scu.edu.

Our Approach

- Invest across the full spectrum of capital required by our alumni social enterprises

- Target investments in post-revenue startups that are too early for uncollateralized debt and not a strong fit for equity

- Use a variety of funding instruments that fit the needs of early-stage founders

- Crowd in outside capital

- Managed by Beneficial Returns

- Dynamically scale up our support of successful enterprises

Competitive Advantages

We can leverage untapped resources to do what no one else can.

- Deep knowledge from the Miller Center Accelerator provides a curated pipeline of investment opportunities

- Technical assistance and acceleration provided by Miller Center de-risks investments

- Trained Santa Clara University students are engaged to support due diligence and reduce costs

For more information, contact MillerCenterCapital@scu.edu.

Investment Readiness and Facilitation

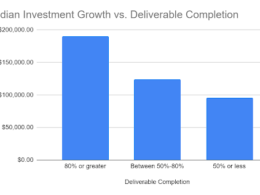

Our Investment Readiness and Investment Facilitation program is offered to alumni of Miller Center’s Accelerator programs. Typically this program is offered 6 months to 3 years post-program to alumni who have demonstrated both a strong track record and ongoing engagement with Miller Center. The program is structured with a phased approach.

Phase I: Investment Readiness

This phase begins with immediate self-guided access to the CASE Smart Impact Capital program. Additionally, participants will be able to join a 2-3 month intensive online and/or in-person mentored program, covering:

- Reviewing and refining your “justifiable ask”

- Developing your due diligence data room

- Developing investor targets

- Developing targeted fundraising collateral

- Creating your networking strategy

Phase II: Investment Facilitation

After the successful completion of the Investment Readiness phase, Miller Center’s internal investment committee will review your justifiable ask. If the ask is compelling and we believe we will be able to meaningfully support your fundraising efforts, you will be eligible for the Investment Facilitation phase of the program. If not, you will be invited to return to the Investment Readiness phase and continue to work with mentors and peers to address the feedback from the committee and re-apply for Investment Facilitation support at a later date.

Investment Facilitation will provide up to 12 months of support around:

- Warm referrals to investors in Miller Center’s network

- Preparing for pitching and meeting investors

- Navigating and negotiating through due diligence

- Deal structuring

- Valuation for your business

- Term sheet negotiation

- Investor management and stewardship

Qualified participants will also receive prioritized consideration from Miller Center’s consortium of impact investing partners including the Truss Fund.

Eligibility will be determined by evaluating your responses to Miller Center’s Alumni Surveys. A member of the Miller Center team will reach out to you if you are eligible. If you have not filled out your Miller Center Survey please do so by emailing mc-alumni@scu.edu.

Eligibility

Miller Center alumni who have met the following prerequisites are eligible for this program:

- Graduated from a Miller Center Accelerator between 6 months to 3 years ago

- Demonstrated strong revenue growth

- A strong track record of implementing the strategic growth initiatives developed in the accelerator program and meeting milestones

- Replied to all Miller Center surveys since graduation and recommended by previous mentors

Email us to get started MillerCenterCapital@scu.edu.

For Impact Investors

We partner with impact investors in a number of ways.

Curated Deal Flow

Let us know your investment preferences by filling out this form and we will send you regular updates with the profiles of aligned and investment ready social enterprises.

Pipeline Development

Miller Center can help you build a robust investment ready pipeline. We partner with impact investors by either running custom cohorts aligned with your investment criteria to identify and accelerate the best social enterprises in a given sector or by partnering with you to accelerating enterprises that are already in your pipeline and bringing them to investment readiness

Portfolio Support

Miller Center partners with impact investors to serve as a technical assistance provider to social enterpises already in your portfolio