Since January, Miller Center has been accompanying 6 microgrid developers across Sub-Saharan Africa to create a new energy infrastructure and close the energy gap. This program is part of our Replication and Scaling Initiative focused on spreading best practices to transfer successful know-how.

We chose develop specific curriculum for microgrids because of:

-

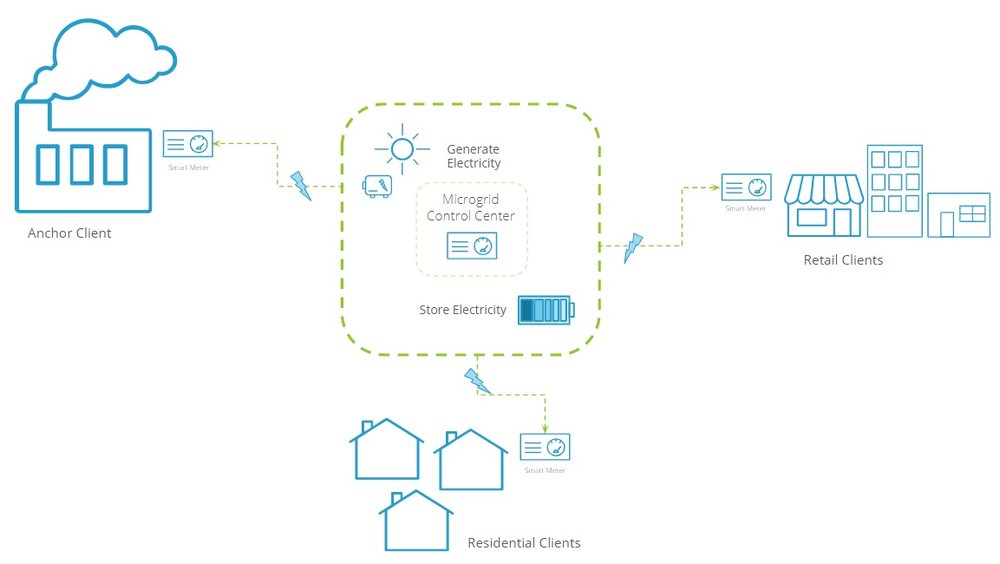

Microgrids are the least expensive way to deliver power for at least 100 million people in Africa, and microgrids can have enormous impact on local economic development by suddenly providing electricity to a whole community

-

There is a growing interest in microgrids including emerging financing vehicles, support organizations, and innovations and cost reductions in technologies such as smart meters and solar panels

-

Our ability to develop curriculum directly from the success and best practices of the 115 clean energy entrepreneurs we have accompanied.

In launching this program we also had a key partner to support our efforts: Energy 4 Impact, which manages the Green Mini-Grid Help Desk in partnership with INENSUS. The Green Mini-Grid Help Desk, funded by the African Development Bank, is part of SE4All’s Green Mini-Grid Market Development Programme.

Utilizing E4I’s deep research into the local energy sector in Africa, we were able to create interactive webinars monthly for both mentors and entrepreneurs to share and learn. These insights from local experts were key to help both Miller Center team members and mentors learn how to support the entrepreneurs even better.

We’ve included our 3 biggest takeaways below:

1) Microgrid Developers are doing a lot

Microgrid business models are some of the most complex that many of our executive mentors have seen. Part of the reason is that the off-grid microgrid sector is nascent and developers must provide many discrete and varied services for which reliable contractors do not yet exist: site selection and assessment of electricity demand, engineering and procurement, operational management, and productive use promotion, including upselling productive load equipment like cold storage, refrigeration and other appliances.

Furthermore, many of the developers are also selling commercial solar or creating new business lines dependent on their microgrid such as purifying water, ice making in fishing communities, agricultural processing, etc.

Mercy Rose, Senior Business Analyst at E4I, shared, “the market is very young so people are still trying to figure out what works– [selling] solar home systems [for example] is more stable so that is their safety net as they explore the microgrid world.”

As the sector grows more niche, organizations may enter the market to provide the services like productive equipment or project management software that support microgrids.

2) Investment is essential

Microgrid enterprises begin serving their customers only after installing a significant amount of equipment. Due to the cost of this equipment and the time spent acquiring customers, we found that most of our teams needed to focus on creating a strong financial model.

Unlike other social enterprises that can subsist in their early years with relatively small amounts of incremental funding, a microgrid enterprise needs substantial capital to launch their first microgrid. And then to grow beyond their first 1-3 microgrids, such enterprises often require $1,000,000+ of capital. While it makes sense that creating infrastructure requires significantly more capital than other social enterprises, this is a significant hurdle for microgrid entrepreneurs. This is compounded by the fact that it takes quite some time to recover costs, especially for entrepreneurs with 1-2 microgrids.

Given the size of investment needs and the risk to set up dozens of microgrids, it became clear that it’s challenging to find the right type of funding for the stage of this sector and these enterprises. Organizations do not want to dilute themselves by giving away too much equity at this early stage, yet debt funding is hard to find for these entrepreneurs.

These findings are mirrored in two different reports that E4I created and shared with our cohort, including:

-

Financial and Operational Bundling Strategies for Sustainable Micro-Grid Business Models – Published in partnership with NREL, this report looks at the various financial bundling methods that micro-grids could employ to achieve sustainable business models. This is particularly interesting since it highlights possible financing options for various micro-grid business structures as well as various stages of project development.

-

Strategic Investments in Off-grid Energy Access – The second report, published in partnership with Wood Mackenzie, looks at the various trends in strategic financing for off-grid energy companies, including financing models and types of investors. It’s interesting to see certain investors who have traditionally not engaged in this space taking interest in the off-grid energy markets.

How can we create staggered investments in this sector that allow organizations to find and deploy grant funding to create infrastructure, then take on equity funding as they scale?

3) Scaling fast vs scaling slow – old rules don’t apply

These microgrid developers were also focused on scaling up very fast, going from pilot systems to raising funding for dozens of microgrids. Through a webinar with E4I, we were able to discuss and learn some of the reasons why this trend toward scaling as quickly as possible is happening, including:

-

Governments, both locally and development organizations like USAID, launch for tenders that request companies supply multiple villages or electrification need for public services such as health clinics and schools.

-

Investors want to see positive return on investments which isn’t possible with one project/site. Therefore, developers must take into consideration a portfolio of microgrids to provide sufficient return on investment.

-

Economies of scale functions is important. How you procure materials, contract out sites, organize staff, etc provide improved margins and return on investment.

E4I shared tips for de-risking this fast scaling including assessing the sites in-person in advance of commitment, ensuring your organizational structure includes a local team to keep local travel and other logistics costs down, and most importantly, hiring engineering procurement and construction contractors who can do construction and the commissioning and help start operations.

These learnings will be utilized to develop even more aligned content for both Miller Center and E4I to share and help support entrepreneurs and the energy access ecosystem as a whole. Check out more insights from Miller Center’s Replication and Scaling Initiative in our newest report linked here.